saad jamil

27 posts

Sep 29, 2025

10:03 AM

|

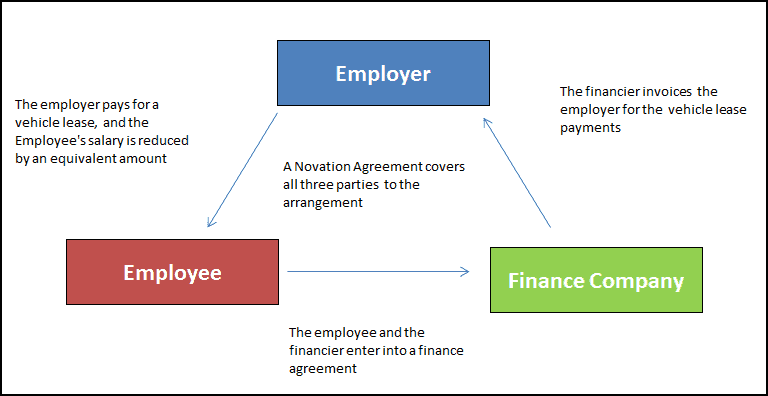

There are five main types of car leases in the UK: PCH, PCP, HP, Business Contract Hire, and Salary Sacrifice. Each works differently in terms of payments, ownership, and tax benefits. When exploring car leasing options in the UK, understanding the different types of car lease agreements available can help you make an informed decision that suits your financial situation and driving needs. Each leasing contract offers distinct advantages, from flexible personal arrangements to tax-efficient business solutions and innovative salary sacrifice schemes Novated Leasing Calculator.

What is Personal Contract Hire (PCH)?

Personal Contract Hire represents the most straightforward form of car leasing for individual consumers. With PCH, you essentially rent a vehicle for an agreed period, typically between two to four years, making fixed monthly payments throughout the contract term.

Under a PCH agreement, you pay an initial deposit (usually equivalent to three to nine monthly payments) followed by fixed monthly instalments. The lease payment covers the vehicle's depreciation during your contract period, plus the finance company's charges and profit margin. At the end of the term, you simply return the car to the provider. This makes PCH particularly suitable for drivers who prefer the best electric cars to salary sacrifice through traditional leasing arrangements.

PCH offers several compelling advantages for personal use. Monthly payments are typically lower than other finance options because you're only paying for the car's depreciation rather than its full value. You'll drive a newer vehicle with the latest technology and safety features, often covered by manufacturer warranty throughout the lease period. Maintenance packages can be included, providing predictable motoring costs with no unexpected repair bills. For those considering electric vehicles, understanding how much it costs to run an electric car can help inform your leasing decision.

The main limitation of PCH is that you'll never own the vehicle, meaning no equity build-up over time. Mileage restrictions apply, with excess mileage charges if you exceed the agreed annual limit. You're also responsible for maintaining the car in good condition, with potential charges for excessive wear and tear upon return.

What is Personal Contract Purchase (PCP)?

Personal Contract Purchase combines elements of leasing and purchasing, offering more flexibility than traditional car leasing options. PCP has become i

|